Business Insurance in and around Omaha

Get your Omaha business covered, right here!

Almost 100 years of helping small businesses

Business Insurance At A Great Price!

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected loss or trouble. And you also want to care for any staff and customers who become injured on your property.

Get your Omaha business covered, right here!

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

Being a business owner requires plenty of planning. Since even your most detailed plans can't predict product availability or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like extra liability and a surety or fidelity bond. Terrific coverage like this is why Omaha business owners choose State Farm insurance. State Farm agent Linda Miller can help design a policy for the level of coverage you have in mind. If troubles find you, Linda Miller can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and call or email State Farm agent Linda Miller to discover your small business insurance options!

Simple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

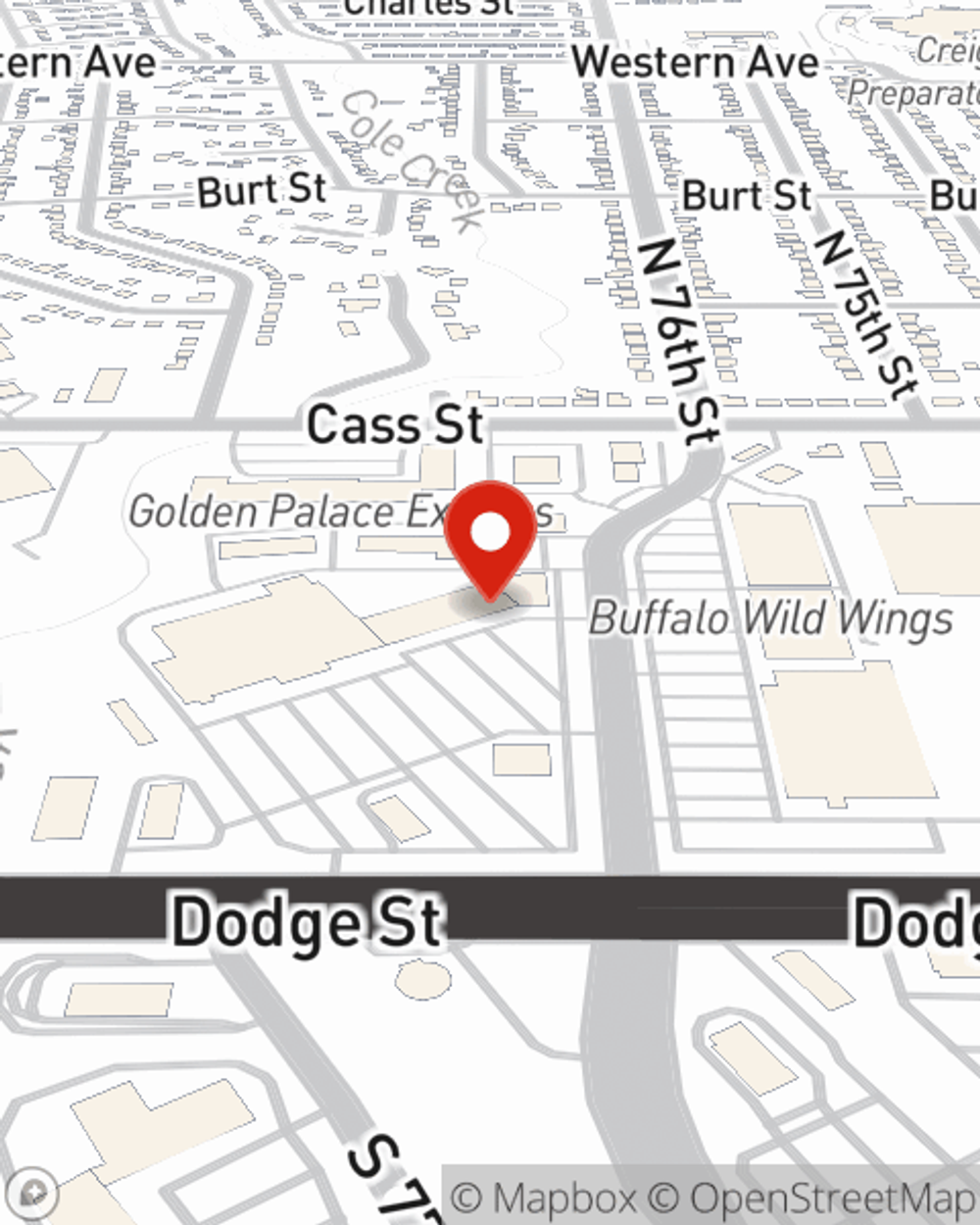

Linda Miller

State Farm® Insurance AgentSimple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.